-

By:

- dane

- No comment

stock market for beginners pdf

The stock market is a platform where companies raise capital and investors seek returns․ It offers opportunities for wealth creation, enabling beginners to grow their financial knowledge and start investing confidently․

1․1 What is the Stock Market?

The stock market is a platform where companies raise capital by issuing shares, and investors buy and sell these shares to earn returns․ It operates through exchanges like the NYSE and NASDAQ, enabling individuals to own parts of businesses․ The stock market allows companies to expand while offering investors the potential for profit through rising stock prices or dividends․

1․2 Why is the Stock Market Important for Beginners?

The stock market is a gateway to wealth creation, offering beginners a platform to grow their savings and achieve financial goals․ It provides opportunities to learn about investing, understand market dynamics, and develop skills in risk management․ By starting early, newcomers can harness the power of compounding, build a diversified portfolio, and gain confidence in making informed financial decisions․

How the Stock Market Works

The stock market enables companies to raise capital by issuing shares, while investors buy and sell these shares, aiming for profits․ Market dynamics, including supply and demand, influence stock prices, with brokers and exchanges facilitating transactions․

2․1 Types of Stocks: Common and Preferred

In the stock market, common stocks represent ownership in a company and grant voting rights, while preferred stocks provide fixed dividend payments and prioritize returns over common shares․ Common stocks offer potential for capital appreciation but come with higher risk․ Preferred stocks, however, are less volatile, offering stability and regular income, making them appealing for conservative investors seeking predictable returns without voting privileges․

2․2 Key Market Participants: Brokers, Exchanges, and Investors

Brokers act as intermediaries, enabling individuals to buy and sell stocks․ Exchanges, like the NYSE or NASDAQ, provide platforms for trading․ Investors are the buyers and sellers of securities, ranging from individuals to institutional funds․ Together, these participants facilitate liquidity, price discovery, and efficient market operations, ensuring the stock market functions smoothly and transparently for all involved․

Key Concepts for Beginners

Key concepts for beginners include understanding bulls and bears, essential terms like EPS, P/E ratio, and dividends, and how market trends impact investments․

3․1 Understanding Bulls and Bears in the Market

In the stock market, a bull market signifies optimism, rising prices, and strong economic conditions, encouraging buying․ Conversely, a bear market reflects pessimism, falling prices, and economic uncertainty, often leading to selling․ Understanding these terms helps investors anticipate trends and make informed decisions, whether to capitalize on growth or protect against losses․

3․2 Essential Terms: EPS, P/E Ratio, and Dividends

EPS (Earnings Per Share) measures a company’s profitability by dividing net earnings by outstanding shares․ The P/E Ratio (Price-to-Earnings Ratio) compares stock price to earnings, indicating if a stock is overvalued or undervalued․ Dividends are portions of profit paid to shareholders, offering income․ Understanding these terms helps investors assess stock value and make informed decisions, whether focusing on growth or income․

Stock Market Strategies for Beginners

Mastering the basics, understanding market trends, and adopting strategies like value or growth investing can help beginners navigate the stock market confidently and effectively․

4․1 Top 3 Trading Strategies for New Investors

For new investors, starting with index fund investing provides diversification and stability․ Value investing focuses on undervalued stocks with long-term potential․ Lastly, dollar-cost averaging reduces market timing risks by investing fixed amounts regularly, helping beginners build wealth steadily without needing to predict market highs or lows․

4․2 Value Investing vs․ Growth Investing

Value investing focuses on undervalued stocks with strong fundamentals, offering a margin of safety․ Growth investing targets companies with high growth potential, even at premium prices․ Value investors seek intrinsic value, while growth investors bet on future success, balancing risk and return based on investment goals and market conditions․

Building a Diversified Portfolio

A diversified portfolio spreads investments across various sectors and assets, reducing risk and maximizing returns․ It balances high-risk and low-risk investments, ensuring stability and growth over time․

5․1 How to Start Investing in Stocks

To begin investing in stocks, open a brokerage account, fund it, and set clear financial goals․ Start with index funds or ETFs for diversification, then gradually explore individual stocks․ Begin with small, manageable investments to build confidence and knowledge․ Educate yourself on market basics, risks, and strategies to make informed decisions and grow your portfolio over time․

5․2 The Importance of Diversification

Diversification reduces risk by spreading investments across different stocks, sectors, and asset classes․ It balances exposure to high-risk and stable investments, protecting portfolios from market volatility․ By avoiding concentration in a single area, diversification ensures steady growth and shields against significant losses; Beginners should prioritize diversification to build resilience and achieve long-term financial goals, starting with index funds or ETFs for broad market exposure․

Managing Risk in the Stock Market

Managing risk involves understanding market volatility, diversifying investments, and setting clear financial goals․ Beginners should start with low-risk strategies and gradually explore higher-risk options as they gain experience and confidence in their investment decisions․

6․1 Understanding Risk and Return

Understanding the relationship between risk and return is crucial for beginners․ Higher returns often come with higher risks, while safer investments yield lower returns․ Diversification helps balance risk, and setting clear financial goals ensures alignment with investment strategies․ Beginners should assess their risk tolerance before investing to make informed decisions that suit their financial objectives and comfort levels․

6․2 How to Mitigate Risks as a Beginner

Beginners can mitigate risks by diversifying their portfolios, avoiding over-investment in a single stock, and using stop-loss orders; Dollar-cost averaging reduces volatility impact by investing fixed amounts regularly․ Starting with small, manageable investments and educating oneself about market dynamics also helps․ Understanding risk tolerance and setting clear financial goals are essential for making informed, safer investment decisions․

Resources for Learning

Discover the best books, free online courses, and guides to master stock market basics․ Resources like Nishit Kumar’s “Stock Market for Beginners” and The Motley Fool’s guides are excellent starting points for new investors․

7․1 Best Books for Stock Market Beginners

Beginners can benefit from books like “Stock Market for Beginners” by Nishit Kumar, offering clear guides on trading strategies and market basics․ The Motley Fool’s “Investing 101” provides foundational knowledge, while titles like “A Beginner’s Guide to the Stock Market” by Matthew R․ Kratter simplify complex concepts․ These books are essential for understanding investing fundamentals, stock selection, and portfolio building․

7․2 Free Online Courses and Guides

Free online resources like “Investing 101” by The Motley Fool and Andrew Sather’s 7-step guide offer comprehensive insights for beginners․ Platforms like Coursera and Udemy provide affordable courses on stock market basics, trading strategies, and risk management․ These guides and courses are designed to help new investors build a strong foundation and start their investing journey with confidence․ Download your free stock market PDF guide to complement your learning journey․

Picking Your First Stock

Research companies with strong financials and consistent performance․ Focus on industries you understand․ Look for stocks with a history of growth and dividends to build confidence in your first investment․

8․1 How to Research and Select Stocks

Researching stocks involves analyzing a company’s financial health, industry position, and growth potential․ Review financial statements, earnings reports, and key metrics like P/E ratio and dividend yield․ Assess market trends and competitive advantages․ Consider diversification to mitigate risk․ Start with well-known, stable companies before exploring more speculative investments․ Prioritize understanding the business model and long-term prospects over short-term volatility․

8․2 Steps to Place Your First Order

Placing your first stock order involves logging into your brokerage account, selecting the stock symbol, and choosing the order type (e․g․, market order or limit order)․ Enter the number of shares and your desired price (if applicable)․ Review the order details, confirm, and execute․ Start with small investments to gain experience and gradually increase as confidence grows․

Getting Started with an Investment Account

Opening a brokerage account is the first step to investing․ Choose a reliable broker, fund your account, and start with small investments to build confidence and experience․

9․1 How to Open a Brokerage Account

Opening a brokerage account is straightforward․ Choose a reliable online broker, complete the registration form, and verify your identity․ Fund your account via bank transfer or other accepted methods․ Once approved, you can access trading platforms to start investing․ Always ensure the broker is regulated for added security and peace of mind as a beginner investor․

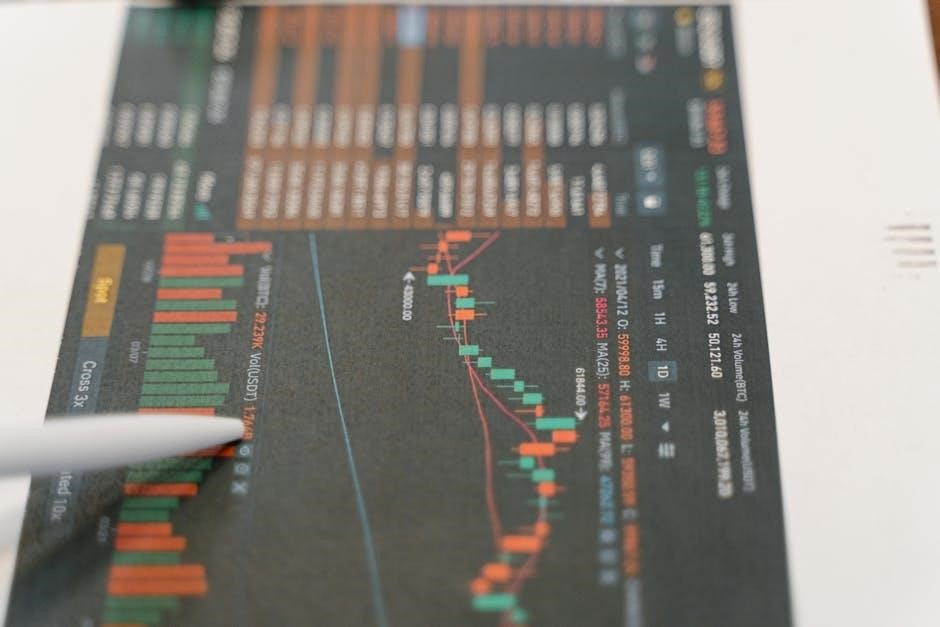

9․2 Understanding Trading Platforms

Trading platforms are tools used to execute trades and monitor markets․ They offer real-time data, charts, and analysis․ Many platforms provide demo accounts for practice․ Choose one with an intuitive interface and essential features like technical indicators and order management․ Ensure the platform is secure, with encryption and two-factor authentication․ Familiarize yourself with its functionality to maximize your trading experience as a beginner․

Embark on your investing journey with confidence․ Download your free Stock Market for Beginners PDF to continue learning and start building wealth today․

10․1 Encouragement for New Investors

Investing in the stock market is a proven way to build wealth over time․ Remember, every successful investor started as a beginner․ Don’t be intimidated—start small, stay consistent, and learn as you grow․ Celebrate milestones, embrace challenges, and stay patient․ Success comes from persistence, not perfection․ Keep learning, and you’ll unlock the full potential of the stock market for your financial future․

10․2 How to Download Your Free Stock Market for Beginners PDF

Accessing your free Stock Market for Beginners PDF is simple! Visit the official website or click the download link provided․ Fill in the required details if prompted, and the guide will be sent to your email․ This comprehensive resource covers essential topics, from basic concepts to advanced strategies, helping you build a strong foundation in investing․ Start your journey today and take control of your financial future!